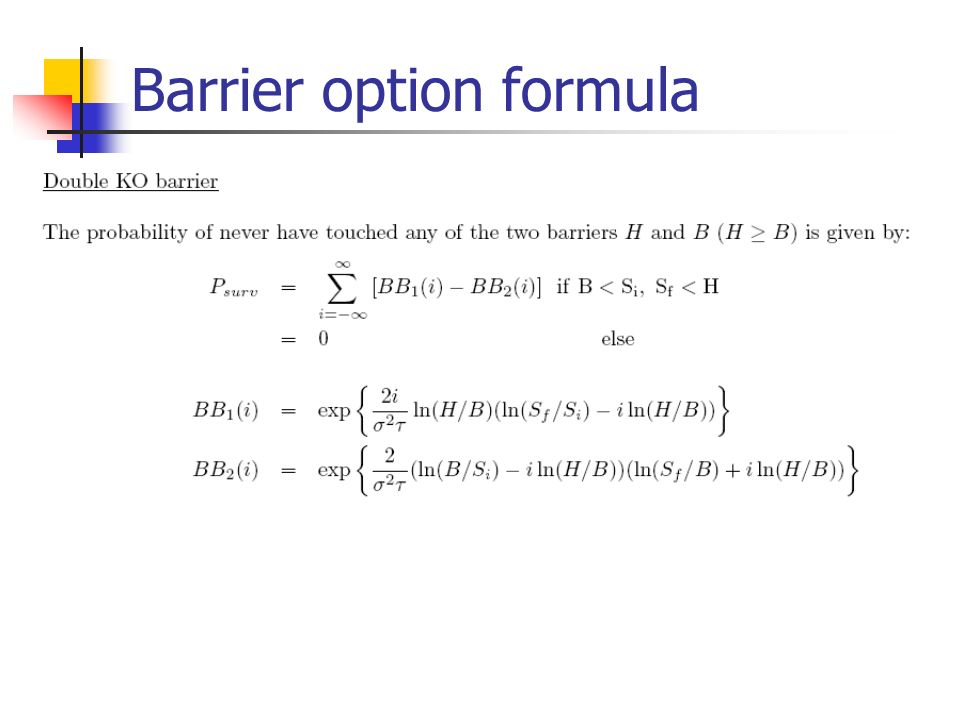

programming - Why does the closed formula result for a Barrier option price deviate so strongly from the Monte Carlo approximation? - Quantitative Finance Stack Exchange

programming - Why does the closed formula result for a Barrier option price deviate so strongly from the Monte Carlo approximation? - Quantitative Finance Stack Exchange

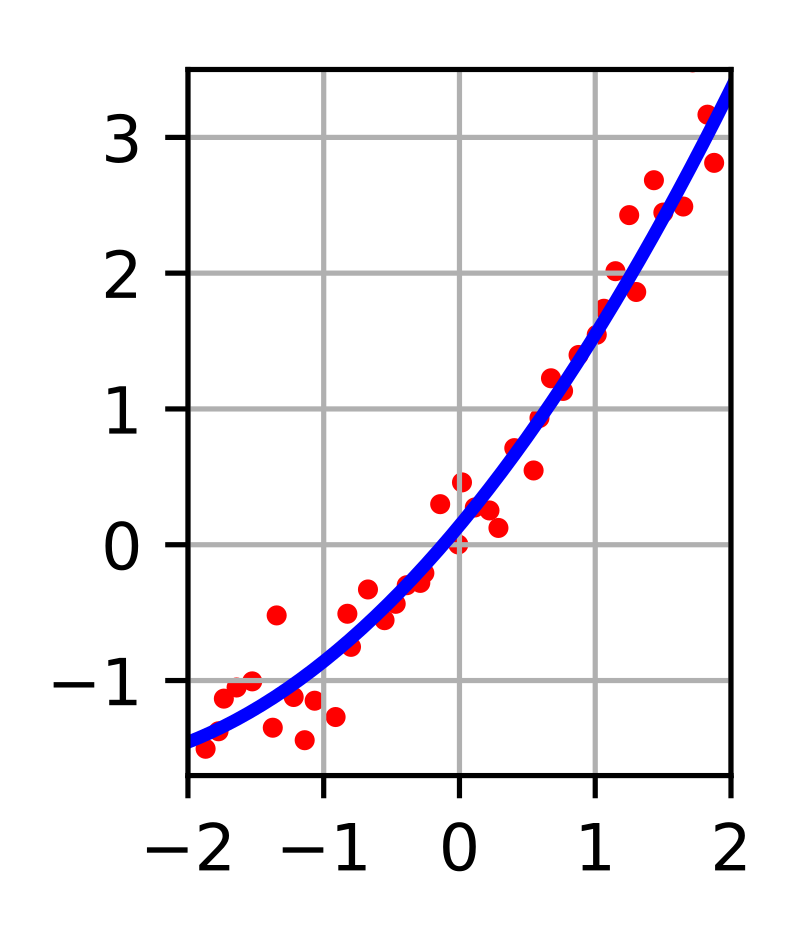

A Closed-Form Model-Free Implied Volatility Formula through Delta Families | The Journal of Derivatives